Knight Frank’s global research teams set out their prime residential price forecasts for 2023

Knight Frank’s global research teams set out their prime residential price forecasts for 2023 and look back at what they got right, and wrong, in 2022.

After two years in which the pandemic fuelled a surge in house prices in most global cities, the landscape is now shifting. Money is becoming more expensive, geopolitics more complex and China is no longer powering the world’s economy.

Homeowners are having to grapple with the unpredictability of soaring inflation, the rising cost of debt and higher taxes.

Although prime markets are more insulated to the fallout from higher mortgage costs, they’re not immune. The transition from a seller’s to a buyer’s market is already underway across most prime residential markets.

But prime prices would need to dip by 30-40% in some cities for prices to return to their pre-pandemic levels of 2019. And the consensus view among most economists is that we aren’t in line for GFC 2.0.

The big picture

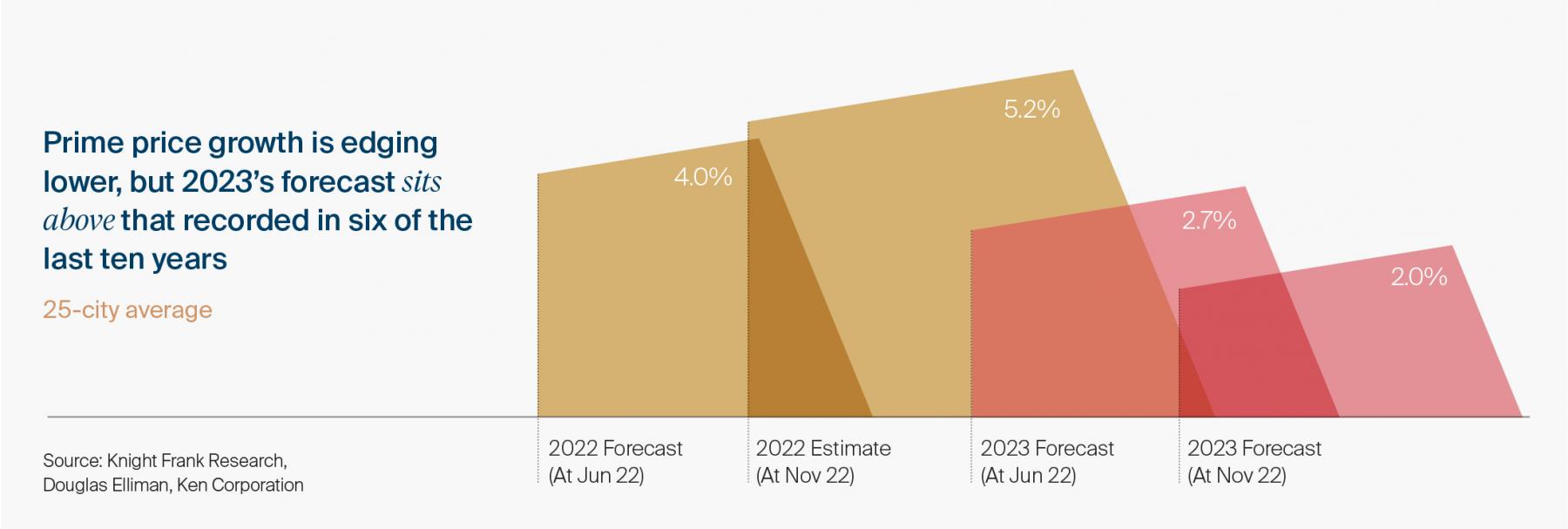

Across the 25 cities tracked, Knight Frank’s global research network now expects prime prices to rise by 2.0% on average in 2023, down from the 2.7% we predicted six months ago.

Despite this slowdown, aggregate growth in 2023 would still be higher than that recorded in six of the last ten years across our prime residential markets.

What's changed

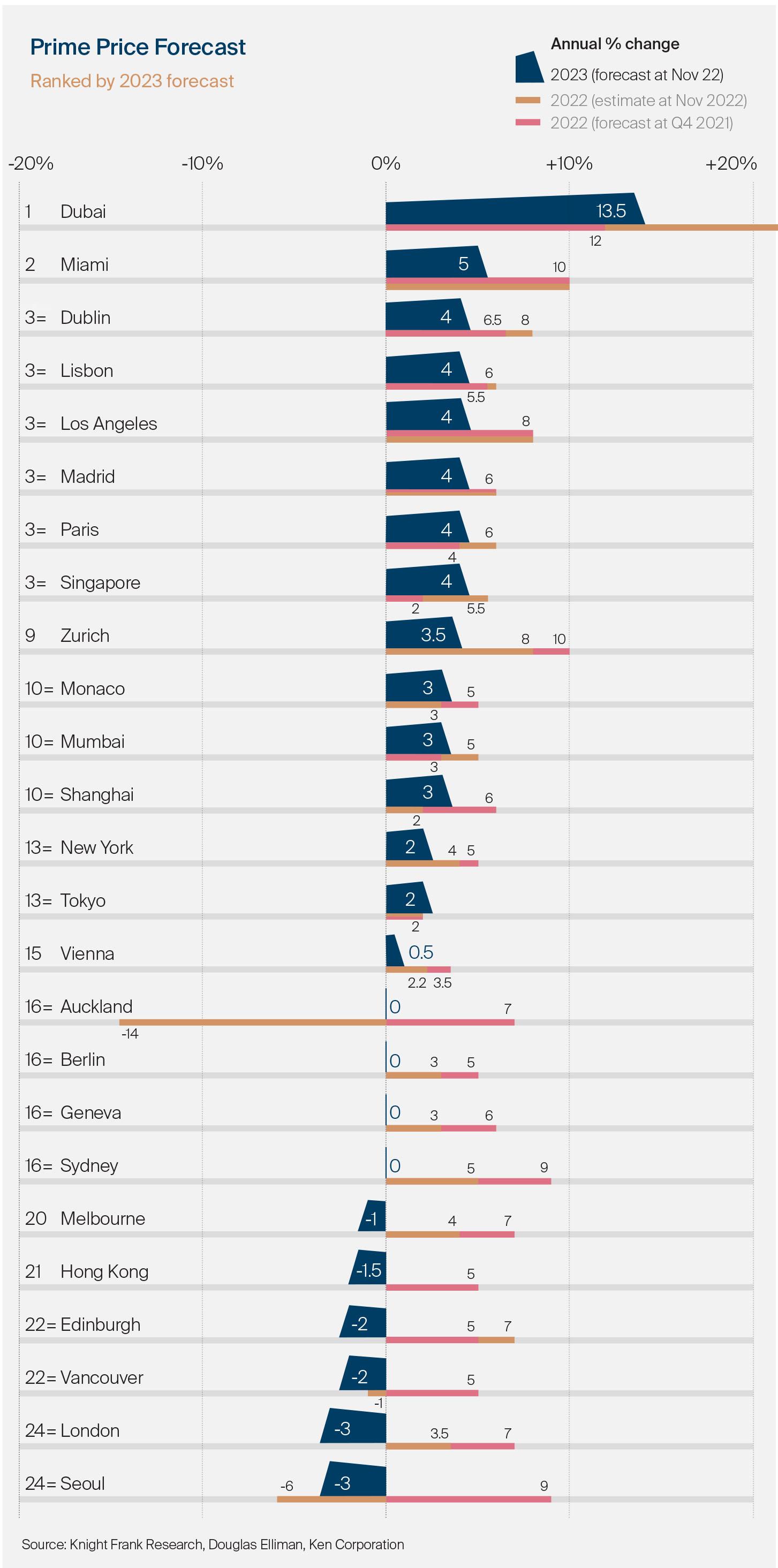

The short answer is not as much as one might have expected given the economic headlines. Fifteen of the 25 cities – or 60% – still expect prime prices to increase in 2023, down from the 18 (72%) we listed six months ago.

Dubai on top

Safe haven capital flight and tight supply in prime markets will cushion prices in some cities in 2023

Dubai leads our 25-city forecast for 2023 with price growth expected to reach 13.5%. Still double-digit annual price growth, but at a more sustainable rate compared with the stellar performance witnessed over the past two years when the city’s relative affordability came into focus.

The US cities of Miami and Los Angeles occupy second and joint third spot respectively, but the forecast rate of growth has dipped in the past six months as recessionary fears strengthen, fixed mortgage rates in the US have exceeded 7% and, in Los Angeles, a Mansion Tax is being considered for homes priced above US$5 million.

European cities rank highly in 2023, occupying six of the top ten rankings with Dublin, Lisbon, Madrid and Paris leading the way. Despite, or perhaps because of, the eurozone’s impending recession, safe haven capital flight looks set to bolster prime markets in the year ahead.

Singapore is the only Asian city in the top ten and one of only four cities whose forecast has climbed in the past six months. New visa measures and the governments’ efforts to attract more family offices are helping to position the city-state as Asia’s regional wealth hub.

At 2%, New York’s forecast for 2023, although down on 2022’s figure, remains above the rate of prime price growth recorded in nine of the past ten years. Overseas buyers are seeking more, rather than less, exposure to the US dollar as the Federal Reserve ramps up rates.

London joins Seoul at the bottom of the rankings with prices set to dip 3% in 2023. But, with prices in prime central London expected to post growth of 3.5% in 2022, values at the end of 2023 will still sit above those in December 2021.

Written By: Kate Everett-Allen, Knight Frank